6 simple questions to tell if a 'finfluencer' is more flash than cash

The Conversation

03 Jul 2025, 18:14 GMT+10

Images of flashy sports cars. Lavish lifestyle shots. These are just some of the red flags consumers should watch out for when they turn to social media for financial advice.

Consumers should not believe everything they see on Instagram, TikTok or YouTube from the growing numbers of "finfluencers" - content creators who build their audience by giving out financial advice.

The regulator responsible for financial products and advice, the Australian Securities and Investments Commission (ASIC), has issued warning notices to 18 social media finfluencers. ASIC said it suspects they have broken the law by promoting high-risk financial products or providing unlicensed financial advice. ASIC did not name them.

So, why is regulated financial advice important and what are some of the common practices finfluencers use to attract followers and customers?

Australian Financial Services laws are designed to protect consumers and investors, while promoting the integrity of financial markets. It is both unethical and illegal to promote financial products without proper authorisation.

In Australia, it is an offence under the Corporations Act to provide financial advice without an Australian Financial Services licence. Penalties include up to five years' imprisonment or fines of A$1 million or more.

ASIC issued a similar warning to online finfluencers in 2022. Since then, the number of social media posts by unauthorised finfluencers have substantially reduced.

Many finfluencers became licensed or authorised representatives of a licensee, along with being more diligent about what they were posting online. Natasha Etschmann, with 300,000 Instagram and TikTok followers at @TashInvests, became licensed immediately after the 2022 warning.

Some other finfluencers were arrested, issued fines or ordered to take down their websites.

However, some finfluencers who style themselves as "trading experts" continue to provide unauthorised financial advice, usually for a fee or commission. They promote high-risk, complex investment products that can cause consumers substantial harm.

These products include contracts-for-difference and over-the-counter derivative products that do not trade on an exchange. ASIC says its current concerns lie with these content creators:

Their social media content is often accompanied by misleading or deceptive representations about the prospects of success from the products or trading strategies they promote, sharing images of lavish lifestyles, sports cars and other luxury goods.

About 41% of young Australians aged 18 to 30 look online for financial information or advice.

While budgeting tips can be helpful, it's important to be extra careful with online financial advice. Consumers should not believe everything they see on social media.

Conducting due diligence and checking finfluencers' credentials on ASIC's Professional Registers search tool is crucial. Choose expert and licensed finfluencers rather than accounts with large followings and exaggerated or misleading claims. Popularity does not always mean credibility.

There are certain red flags to watch out for. Some finfluencers use pseudonyms. They promote "exclusive" financial advice content and access to "invitation-only" online communities for a fee. In many cases, they lack credible experience or certified financial planning training to provide financial advice.

When choosing to follow or acquire the services of a finfluencer, ask:

is this finfluencer licensed or authorised?

how realistic are the promised financial outcomes? Are they too good to be true?

does the finfluencer disclose their personal financial position or investments when discussing financial products or strategies?

are they transparent about? their track record of accuracy or accountability?

do they address publicly a case when their audience lost money from a strategy they recommended?

does the finfluencer tailor content to different investment risk profiles or financial maturity levels in their audiences?

Social media finfluencer content can often come with misleading or deceptive representations (such as the sports cars and luxury goods that ASIC has warned about). Content may overstate the prospects of success and potential profits.

Some - usually unlicensed - finfluencers use social media content as "proof" of their financial expertise. One common practice is to try to lure consumers by creating a hyped world around their own personal lifestyle. Many finfluencers often extend invitations to consumers to join closed forums to "learn" their hidden secrets to success or copy their "famous" trading practices.

These finfluencers usually try to convince consumers they can achieve a similar lifestyle by following their advice.

ASIC issued the warnings as part of a recent global week of action. ASIC and eight regulators from the United Kingdom, United Arab Emirates, Italy, Hong Kong and Canada took coordinated action to disrupt unlawful finfluencer activity.

The global campaign aims to raise awareness about unlawful finfluencer activity, protect consumers, and prevent them from investing after encountering misleading content.

Consumers need to distinguish between credible financial advice and self-serving or misleading content before trusting their money to anyone.

Spotted unlicensed influencer activity? Report this misconduct to ASIC.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of International Technology news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to International Technology.

More InformationComputers

SectionApple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Seminar held in national capital focusing prospects of Artificial Intelligence in Northeast region

New Delhi [India], July 2 (ANI): A seminar on the prospects and possibilities of artificial intelligence in Northeast India was organised...

NMDC expands global footprint with its new office in Dubai, forging global pathways in mining

Hyderabad (Telangana) [India], July 1 (ANI): NMDC, India's largest iron ore producer, marked a significant milestone with the inauguration...

China completes barrier belt to prevent eastward expansion of its fourth-largest desert

YINCHUAN, July 1 (Xinhua) -- China on Monday reached a major milestone in desertification control by completing a barrier belt along...

Elite Women's Boxing Tournament: Lovlina Borgohain storms into semifinals

Hyderabad (Telangana) [India], June 29 (ANI): Olympic Games Tokyo 2020 medalist Lovlina Borgohain eased past Punjab's Krisha Verma...

Ankushita Boro, Nikhat Zareen advance to semi-finals at Elite Women's Boxing

Hyderabad (Telangana) [India], June 29 (ANI): Former youth world champion Ankushita Boro showcased her class on Day 2 of the Elite...

Internet

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Ukrainian membership of EU would destroy blocs economy Orban

Kievs accession to the bloc would drag both Brussels and Budapest into conflict with Moscow, the Hungarian prime minister has said...

6 simple questions to tell if a 'finfluencer' is more flash than cash

Images of flashy sports cars. Lavish lifestyle shots. These are just some of the red flags consumers should watch out for when they...

Brits fail to fix stranded F-35 stealth fighter in India media

A crew from the UK has reportedly been unable to repair the aircraft for over 19 days A British F-35B Lightning II stealth fighter...

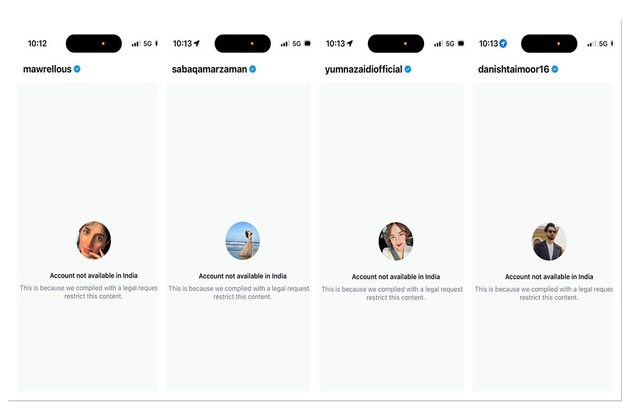

Pakistani celebrities' social media accounts remain blocked in India

New Delhi [India], July 3 (ANI): The social media accounts of several Pakistani actors and cricketers remain blocked after it was reported...